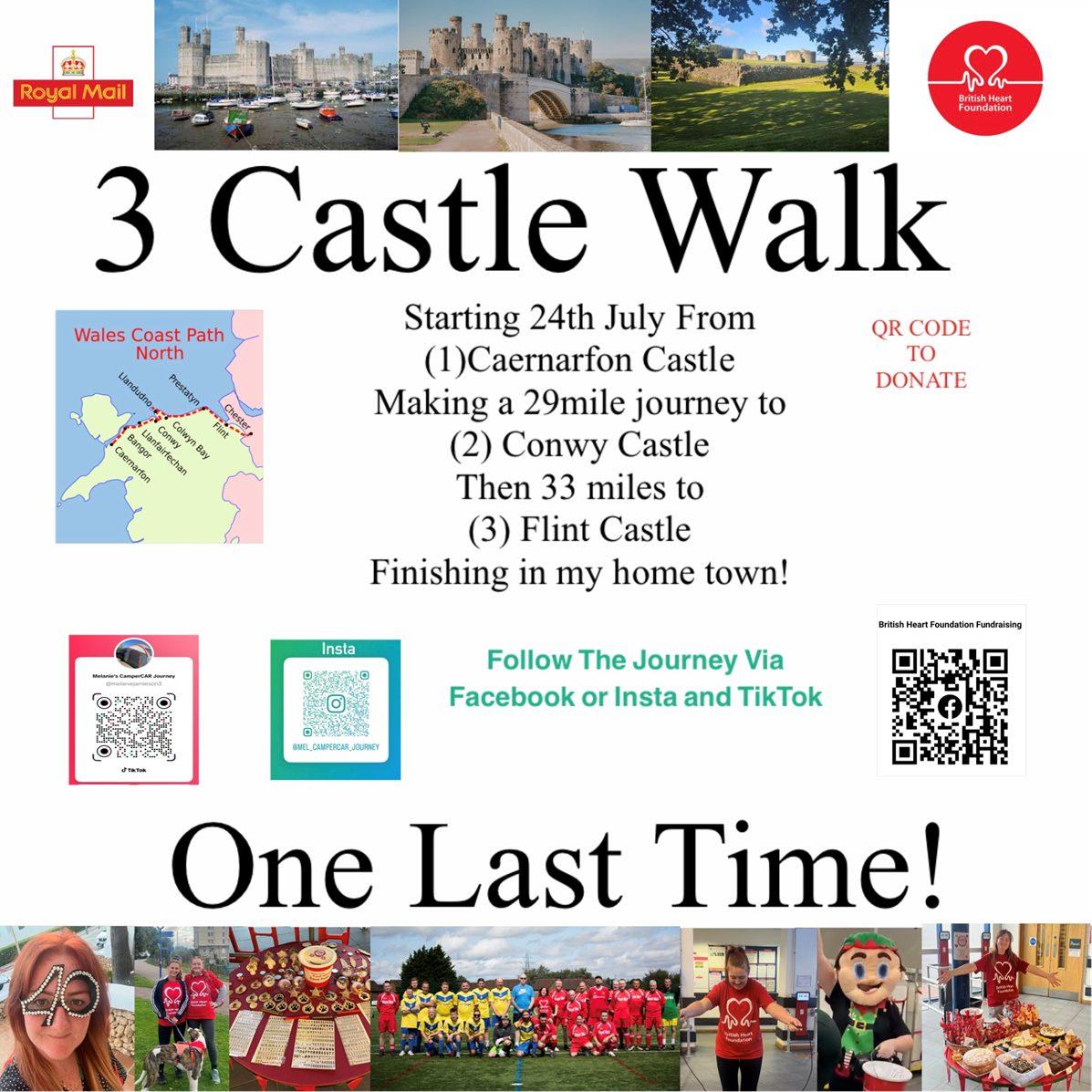

Your donation to Mel’s Summer Challenge for The British Heart Foundation

Starting on 24th July I will be taking on an epic 3 Castle Walk! Starting at Caernarfon Castle, making my way 29 miles to Conwy Castle then the longest leg of 33 miles to Flint Castle.

This challenge will more than likely take me 4 days but I’m hoping to do it in 3! I will be camping out in my camperCAR if I can persuade my dad to move it to my daily destination, failing that I’ll have to buy myself a little one-man tent.

Day 1 – Setting off from Caernarfon Castle and walking as close to Conwy Castle as possible. It’s a 29 mile walk between the two so I won’t be doing it in one go.

Day 2 – I’ll leave my overnight camp and head the rest of the way to Conwy castle and then continue on the 33 miles towards Flint before another overnight stop in my camperCAR.

Day 3 – Leaving camp early, I’ll head towards Flint Castle, hopefully I’ll be close enough to finish on this day, but I have 1 more day just in case.

Day 4 – With any luck I’ll be back at home and able to rest my weary legs and sore feet, failing that I’ll be finishing off the last few miles!

This is a solo challenge, but I am hopeful that people will join me for parts of the walk to keep me company and spur me on. I really appreciate you reading about my challenge and helping me get closer to my walk target of £1000

Melanie 😊